In an attempt to not believe what politicians tell me without fact-checking, I tried to unravel the new tariffs from the US. I am taking the view that President Trump is trying to do the best for his country, you can decide for yourself whether you believe this. His rhetoric is that in the distant past things were more fair, since then the US has been plundered, and he now wants to even the score.[1] But is this true? The perception elsewhere is that since this time, the US has become a world power, and this is due in part to free trade.

Free trade (I am reliably informed by the economists in my world) is when countries have trading partners and allow goods and services into and out of their countries with relative ease. Economists seem to agree that free trade is what makes strong economies. With free trade, everyone has an easier life. But, have other countries eroded this (as Pres. Trump states)?

Well, to some extent, from what I can discover, there have been some limits to free trade. Sometimes a country wishes to protect its citizens from something considered unhealthy. (In the UK, only toys that meet a certain standard can be sold for children–so some toys from China are rejected. In the UK, we dislike genetically modified beef, so refuse imports based on that. And so on.) Countries also add their own taxes. (In the UK, we have VAT—a tax that is added to goods before they are sold—which in the US is called ‘sales tax’—but VAT is applied to those good wherever they come from, even if made in the UK. So to list these as a ‘tariff on the US’ would be untrue.) Some countries have made sale agreements: My understanding is that car manufacturing is particularly cosmopolitan, with different components being added in different countries, so a car may pass between Canada and Mexico and the US, getting bits added, until it is finally ready to sell. Each time it has a part fitted in a new country, there has been agreement that no extra tax will be added to the final cost.

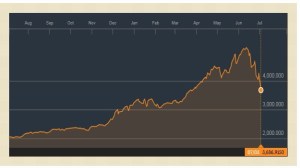

Now, despite what Pres. Trump said, the US has actually benefited from the global economy. Evidence for this is found in things like: Any country in the world will accept dollars (we take dollars when we travel to India). The US is seen as powerful, and is included in talks concerning climate or security. Services from the US have prospered; in the UK, Amazon is huge, so is Google, and Apple, and Microsoft, etc. American banks are strong. Across the globe, countries have welcomed companies like McDonald’s. Normal people in the US have benefited from this, it has supported their own economy. Yes, there has been a decline in certain industries—this is true everywhere. In the UK, whole towns were built on coal or steel, and they have needed to diversify, and find new industry, and this has not always been easy or smooth. But the US has sold many services abroad, and overall has grown stronger. Therefore, it seems the world has not ‘raped’ the US, but rather the US has done very nicely out of free trade, thank you very much.

I looked into what tariffs have actually been set, and why. It seems they are based on trade deficit—this is when the country sells less of a product than it buys, it’s a number. (US buys 100 televisions, it sells 40 televisions, therefore the trade deficit is 60.) Pres. Trump took the trade deficit with each country, divided it by the number sold, then divided by 2. (In my example, 60/100 divided by 2) However, he has only looked at the trade deficit of goods (actual stuff) not services (like Amazon, or banks, or IT) so it is rather skewed. And my understanding is that his method is ‘deeply flawed.’[2] Never mind the human cost, because breaking trade agreements does not make you an attractive partner in the future.

My conclusion therefore is that, from the evidence I can find, the new tariffs are not wise. They are not ‘fair’ because they are based on faulty economics, and they will not benefit people living in the US. But they may isolate the US from the rest of the free world.

The advice to the rest of the world appears to be that we should assume the US is ‘going it alone’ and we should make fresh deals with non-US partners. (As I showed yesterday, some supermarket shoppers now avoid goods from the US.) This potential decline seems a shame to me, I like the US, I have no wish to see its economy slump. I think there is a real danger that poverty in the US will increase, which often leads to more crime and unrest. I find this very sad.

I also worry about the impact on less developed nations. The US was generous towards those countries struggling with HIV, it helped to keep peace in the world, it was a good country. I worry that the loss in aid will be devastating for the poorest in our world. Never mind that we will have to pay more for Apple products (and will probably switch to non-US ones)—that is insignificant. What will happen to the poor in our world? Those are who we should be fighting for, and I hope that the people in the US, who are mostly good people (in my experience) will remember they have a privileged place in helping to restore balance in the world.

Thanks for reading. If you have further insight, do add to the comments.

Have a good week, and take care.

Love, Anne x

anneethompson.com

[1] Trump ‘glorifies’ the ‘era of the late 19th century’ and hopes to return to this economy. Zanny Minton Beddoes, Economist Online, April 2025. See also point (1) from yesterday’s blog.

[2] Financial Times Online, April 2025.